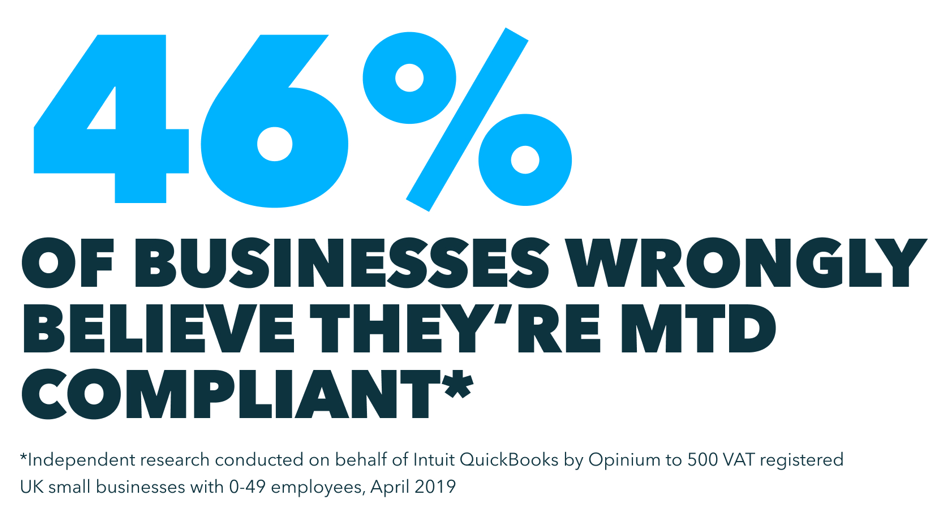

What is Making Tax Digital?

Making Tax Digital is part of the government’s plans to make it easier for individuals and businesses to stay on top of their tax and keep their affairs in order. Essentially, HMRC’s goal is to “become one of the most digitally advanced tax administrations in the world.”

What this means for taxpayers is that they will be giving HMRC details of their revenue and costs using accounting software on a quarterly basis and a full year tax return at the end of the year rather than completing the usual tax return once a year.

Benefits to using accounting software to file taxes:

• Accessible anywhere to business owner, bookkeeper, and accountant without having to email files or backups

• More efficient data entry through receipt capture apps, linked tills, linked e-commerce, and bank feeds

• Built in data sense checks

• Ability to raise invoices from a phone while still on site

• In person payments by card etc while still on site

• Generation of recurring invoices for retained work

• Instant conversion of quotes into invoices

• Automatic invoice chasing and links to credit control apps

• Simple management reporting

• getting paid faster

• spending less time on admin

• no need for backups or upgrades,

• improved cash flow since you have a good idea throughout the year of how much tax you owe.

MTD for Income Tax

MTD for Income Tax Self-Assessment (also known as MTD for Income Tax) commences on 6 April 2026.

You need to follow the requirements for Making Tax Digital for Income Tax if you are self-employed or a landlord from:

• 6 April 2026 if you have an annual business or property income of more than £50,000

• April 2027 if you have an annual business or property income of more than £30,000

MTD for Sole Traders

Sole trader is a description of a business type for tax purposes. This includes all kinds of people and businesses – from freelancers to self-employed and gig economy workers.

Sole traders will have an MTD for Income Tax “digital start date” for their business. That means it will be the same date as the start of their first full accounting period following 6 April 2026. If you use the tax year for your accounting period (6 April to 5 April), once the new tax year begins is when you’ll need to use MTD for Income Tax.

The £50,000 income threshold applies to the individual and could come from just one business, or multiple entities. For example, if you owned and operated five businesses and each had an income of £12,000 you would need to register for MTD for Income Tax and follow its legislation for all of the businesses.

MTD for Landlords

Whether you consider yourself a professional landlord (e.g. you pay Class 2 National Insurance contributions) or not, anyone receiving more than £50,000 from rental income must follow the MTD rules.

Commercial property furnished holiday lettings (FHL) and non-UK properties fall within the scope of MTD as well.

Even individuals who have inherited a single property that they rent out may not be aware that they’re running a business in the eyes of HMRC and that MTD for Income Tax may be applicable to their situation.

The important thing is that if you’re a landlord you need to register for MTD and keep digital records relating to your property rentals.

Let’s say you have property that brings in rental income of £51,000 per year. This is above the threshold, so you will need to use MTD for Income Tax for the accounting relating to your property. Moreover, if you’re a sole trader, you’ll need to use MTD for Income Tax for the accounting relating to this aspect as well.

Who Doesn’t Need to Use MTD for Income Tax?

The following persons and entities are not currently required to join MTD for Income Tax:

-Other types of partnerships that are not general partnerships with only individuals as partners, such as Limited Liability Partnerships (LLPs)

-Trusts and estates

-Trustees of registered pension schemes

-Non-resident companies

MTD for Corporation Tax

While MTD for Income Tax is quickly approaching, companies won’t need to report under MTD for corporation tax until at least April 2026. However, HMRC aims to start a pilot scheme for companies from April 2024 to start filing using MTD for Corporation Tax.

Currently, there is no minimum threshold.

MTD for Corporation Tax requires companies to keep digital records, provide quarterly summary updates of income and expenditure to HMRC (which will show expected Corporation Tax liability), and provide a digital submission of a Corporation Tax Return.

What You Can Do to Prepare for These Changes?

It is important that you use this information to better prepare yourself and abide by MTD rules. When submission deadlines are missed, and financial penalties can be applied.

The best way to prepare for these upcoming changes is to start looking to introduce cloud accounting software. Adapt your systems and policies to the new software ahead of your relevant MTD implementation dates. If you need assistance with this, please talk to us.

If you’re already using software, ensure you upgrade to the latest version, your accounting software will need to provide regular, timely data to HMRC.

In Conclusion

To ensure you are ready for MTD, identify the dates that apply to your situation, talk to your accountant, and find the right software for your needs.

If you’re looking for help and need an accountant, get in touch with us, to request a free consultation and we’ll be happy to discuss your specific situation and MTD needs.

Links to HMRC’s MTD for ITSA guidance on GOV.UK are provided below.

• To check if you are eligible for MTD for ITSA – see HMRC’s guidance – Check here

• To check when you must sign up to MTD for ITSA – see HMRC’s guidance Check Here

• To find out about keeping digital records, signing up and using software to send income and expenses updates – see HMRC’s guidance Here

• To apply for an exemption from MTD for ITSA – see HMRC’s guidance Here

• For information about out how to use MTD for ITSA instead of a Self Assessment tax return and how to sign up if you’re eligible – Click Here